Can Innovation Help Protect High-Value Agri Exports in a Volatile Trade Environment?

Recently, Absa released its latest AgriTrends “Autumn” report, and with it, a very strong warning. South Africa’s high-value agricultural exports are facing growing uncertainty. With rising global trade tensions and increasingly complex market dynamics, the report warns that some of the country’s most profitable export commodities are now at serious risk.

Top of the list? Citrus, wine, nuts, raisins, etc... the very backbone of South Africa’s agricultural trade relationship with the United States, Europe, and Asia. These commodities play a leading role in driving growth across the agricultural sector. Any disruption to their export performance sends ripples through the entire sector.

As I went through the report during the easter weekend, one specific section caught my undivided attention. Section 4, on High Value export products. Amid ongoing debates about AGOA tariffs, trade diversification, and global geo-politics, a few questions came to mind. What role does innovation play in protecting firms in the high-value agricultural sector from market volatility? And just as crucially, how are these firms responding? are they appropriately investing in innovation? and is there any sign of optimism in the data?

To explore these questions, I turned to the AgriBIS 2019–2021 dataset to see what insights might emerge. The objective was to better understand whether innovation can be used as a sword and a shield or whether innovation can function as a real lever of resilience in this increasingly tense trade environment.

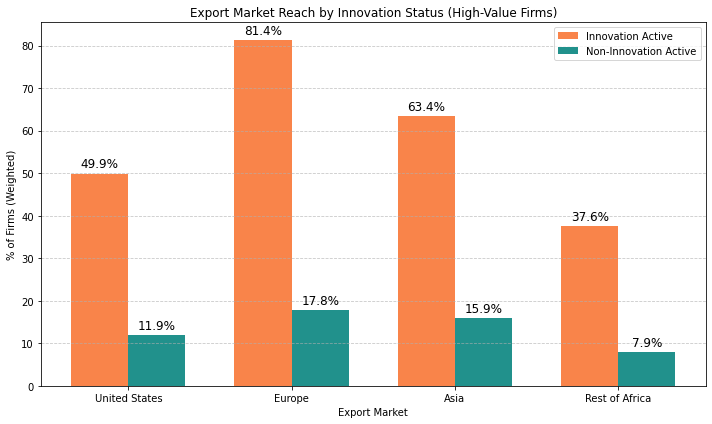

The first step was to determine which markets high-value innovation-active firms were exporting their products. Using the relevant SIC codes, I filtered the AgriBIS 2019–2021 dataset to isolate firms within this subsector that reported engaging in innovation. The dataset includes indicators for geographic market reach, such as Europe, the United States, Asia, and the Rest of Africa, which enabled a comparative analysis of where innovation-active versus non-innovation-active firms were exporting. This helped reveal the global markets most closely associated with innovation activity.

The answer was very clear. Innovation-active firms dominate every major export region. Nearly half (49.9%) of innovation-active high value commodity firms export markets include the United States — precisely where 30% citrus tariffs have recently come into effect. Over 80% exported their goods to Europe. These firms are core exporters in high-value subsectors. And their exposure to trade policy shocks is real.

Analysis of South Africa's AgriBIS 2019–2021 data shows that over 80% of innovation-active high-value agri firms, export their goods to Europe, and 50% to the US — where new tariffs threaten growth of this subsector.

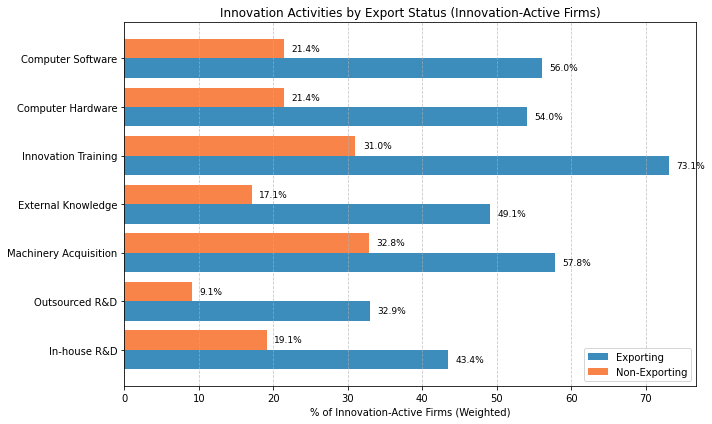

I then focused only on those innovation-active firms that reported reaching new markets as an actual innovation outcome. What I found was quite interesting.

Firms exporting high-value commodities were not merely upgrading equipment or making minor improvements. They were committing to substantial innovation efforts. These included investments in human capital through training, strengthening internal capabilities via in-house R&D, tapping into external knowledge sources, and upgrading digital infrastructure—both hardware and software.

The data suggests a strategic orientation toward innovation. Very well structured, intentional, and aimed at building the capabilities required to access and compete in new markets.

In contrast with the non-exporting innovators, they were also investing — but not at the same intensity, and not with the same spread.

Absa’s report shows us that: High-value commodities (like citrus, wine, grapes) are among the top exports under AGOA — and that tariffs, especially the 30% US “Liberation Day” tariff, could deal a significant blow. The AgriBIS 2019-2021 data, on the other hand, shows us that these commodities are led by innovation-active firms, many of which are now caught in the crossfire of global politics.

Export success is tied to deeper innovation capacity. The data show that High-Value Agri firms that reached new markets are investing seriously across multiple innovation activities.

The analysis of the data makes one thing clear: export resilience and global integration are tied to innovation capacity. As AGOA trade tensions rise, the firms most at risk are also those furthest ahead.

So, what should policymakers make of this? I won’t pretend to have all the answers now, but this is precisely the kind of evidence that warrants deeper analysis. I am probably going to do further analysis, and write a policy brief to bring these insights more fully into the ongoing innovation policy debates.

There are no comments yet on this post. Be the first to comment!

Leave a Comment

Subscribe To My Weekly Newsletter.

Stay updated on the latest insights in innovation, data science, and digital transformation. Subscribe to receive valuable content, industry trends, and actionable strategies delivered straight to your inbox.

Subscribe